Contents

Yes, it is possible to get a Jumbo mortgage with a debt to income ratio above 43% . In fact , Jumbo mortgages are available with debt to income ratios up to 55% . To get more information about these programs fill out the quick quote form.

Yes, it is possible to get a Jumbo mortgage with a debt to income ratio above 43% . In fact , Jumbo mortgages are available with debt to income ratios up to 55% . To get more information about these programs fill out the quick quote form.

People in the region are earning more money now, so the income-to-home-price ratio is similar to what it was in the. the.

Front end ratio is a DTI calculation that includes all housing costs (mortgage or rent, private mortgage insurance, HOA fees, etc.)As a rule of thumb, lenders are looking for a front ratio of 28 percent or less. Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

The company has a current ratio of 0.11, a quick ratio of 0.11 and a debt-to-equity ratio of 0.29. services related to public and private fixed income, public equity and real estate, commercial.

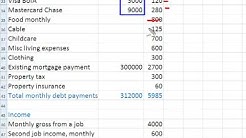

Debt to income ratio. lenders use "debt to income ratio" to determine the most you can pay monthly after your other monthly debts are paid. How to figure your qualifying ratio. typically, underwriting for conventional mortgage loans requires a qualifying ratio of 31/45, and up to 65% for HARP loans.

Conforming Jumbo Loan Rate Fannie Mae minimum loan amount Did Fannie Mae Overpay Bank Of America For Servicing Rights? – The report, issued by the inspector general for the federal housing finance agency (fhfa), concludes that Fannie Mae is probably contractually required to pay a breakup fee in order to shift troubled.Conforming loans are backed by Fannie Mae and Freddie Mac, and are typically below $726,525. Nonconforming or "jumbo" loans have higher values and interest rates. We’ll help you choose the right.

The Homebuyer’s Guide to Jumbo Loans | PennyMac – Lenders may also require a stronger debt-to-income ratio to secure a jumbo mortgage. Many lenders require a debt-to-income ratio in the 38-43% range, meaning your monthly mortgage payment can’t be more than 43% of your pretax income.

Why Should You Choose Us For Your Jumbo Mortgage? We work for You & Not the Bank. When working with us your not "stuck" with ONE bank’s restrictive set of underwriting guidelines which can put caps on your debt to income ratio or require a lot of mortgage reserves!We always seek out the best lender to suit your specific situation and find lenders with the Best Rates!

On jumbo loans, the maximum debt to income ratio is 35% to 43% depending on the loan program. Conforming loan reserve requirements range from 0 to 12 months, depending on factors such as credit score, down payment, and DTI .

Difference Between Family And Living Room What is the difference between a den & a living room? | Yahoo. – Best answer: living room is more for a formal occasion for special holidays, guests to visit. A family den, is more along the lines of watching TV, where the computer is, a place to just hang with family and friends. Put the entertainment center in the Den.